Valo Holdings Group is a Florida-based Venture Capital company. Jana Seaman is the CEO of this firm.

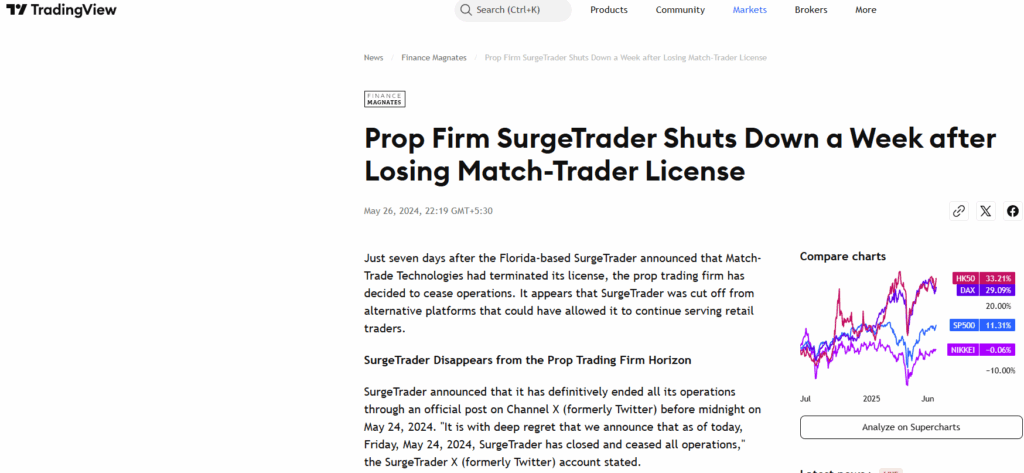

She is the same person who ran SurgeTrader, a prop firm which shut down abruptly and cost millions of dollars to its traders.

Those traders didn’t see a penny. Their funds were gone.

It seems Jana Seaman used the funds she made from the SurgeTrader scam and spent them on creating Valo Holdings Group.

The SurgeTrader Prop Scam By Jana Seaman

SurgeTrader promised a fast track to professional trading. With a sleek platform, aggressive marketing, and funded account offers, it pulled in thousands of traders worldwide. But by mid-2025, the dream unraveled into a nightmare. Payouts stopped. Emails bounced. Traders were left hanging.

At its peak, SurgeTrader was seen as one of the more accessible and ambitious prop trading firms. It catered to retail traders hungry for a shot at managing large capital without risking their own money. The pitch was clear: pay a small fee, pass a challenge, and gain access to funded accounts where you could keep up to 90% of the profits. It sounded like the perfect deal—and for a while, it worked.

Traders across the globe shared success stories. Social media influencers promoted the firm. Review platforms were filled with glowing praise—until cracks started to show. By early 2025, reports of delayed payments began surfacing. Traders who had successfully hit payout milestones started facing vague excuses or outright silence. The company shifted policies without notice and became increasingly difficult to contact.

For many, it felt like the floor had been pulled out from under them. Some had invested months building up trading histories with the firm. Others had passed multiple challenges and were waiting on life-changing payouts. Instead, they were left with dead-end support tickets and broken promises.

This article breaks down what really happened with SurgeTrader, who got hurt, and what the collapse means for traders still navigating the unpredictable world of proprietary trading.

What Is SurgeTrader?

SurgeTrader launched with a simple pitch: prove your skills, and we’ll fund your trading. Like many proprietary (prop) trading firms, they built their model around evaluation-based funding. Traders would pay an upfront fee to enter a challenge—essentially a performance test. If they met the firm’s strict trading criteria, such as profit targets, drawdown limits, and risk management rules, they were promised access to a live funded account with real capital.

The firm claimed to offer funding from $25,000 up to $1 million, depending on the challenge level chosen. Once funded, traders could earn a high percentage of the profits they generated—reportedly up to 90%, which placed SurgeTrader among the more aggressive profit-sharing models in the industry.

SurgeTrader’s appeal was built on three core promises: speed, scale, and simplicity. Unlike some competitors, they advertised no multiple-phase evaluations or demo accounts. Instead, they pushed the idea of a “one-phase” model: pass once, and you’re in. Their payout cycle was said to be bi-weekly, a key selling point for traders who wanted fast access to their earnings.

They marketed themselves as a clean alternative to more bureaucratic or slower firms like FTMO or MyForexFunds. Professional branding, a user-friendly dashboard, and strong influencer partnerships helped build their credibility fast.

In a market saturated with prop firms, SurgeTrader aimed to cut through the noise with bold claims and bigger rewards. But as many traders would later learn, what looked like innovation was hiding serious internal flaws—and eventually, a full-scale collapse.

The Red Flags Before the Collapse

Long before the lights went out, traders noticed things weren’t right. What had started as minor inconveniences turned into unmistakable red flags.

By early 2025, payout delays began surfacing. Traders who had previously received fast payments suddenly found themselves waiting weeks with no updates. At first, SurgeTrader blamed “processing issues” or “backend upgrades.” But the excuses grew vaguer—and the wait times longer.

Around the same time, the rules started changing. Traders reported being disqualified for obscure or newly introduced violations that hadn’t existed when they started. Risk parameters shifted without prior notice, and trading accounts were deactivated without proper explanation. Many suspected the firm was intentionally tightening restrictions to avoid paying out successful traders.

Customer support became a dead end. What was once a responsive team turned into a ghost crew offering templated replies—or none at all. Emails bounced, live chat stopped functioning, and support tickets lingered unresolved for weeks.

The trader community started connecting the dots. On forums like Reddit and review sites like Trustpilot and Forex Peace Army, stories piled up: consistent profits being denied, accounts flagged without cause, and total communication breakdowns. Some traders even documented their experiences with screenshots, showing payout promises made—and broken.

Still, many held on, hoping the issues were temporary. But by the time the pattern was undeniable, it was too late. SurgeTrader had already siphoned off the last of its credibility—and in many cases, its users’ money. The warning signs were there, but they were buried beneath silence and spin.

The Scam Revealed: What Happened?

The full unraveling came swiftly in March 2025. Without warning, SurgeTrader went dark. Traders trying to log into their dashboards encountered broken pages or error messages. The firm’s main website remained live—creating the illusion of business as usual—but behind the scenes, operations had ground to a halt. No support, no payouts, no communication. Not even a public statement acknowledging the issues.

As traders dug deeper, a disturbing picture began to form. Bank accounts associated with payouts had been drained, according to leaked internal chats and user-submitted reports. Previously active payment processors were no longer linked. Those waiting for their scheduled withdrawals realized they were never coming.

SurgeTrader had also never published legal disclosures or undergone any third-party financial audits. Despite managing millions in trader fees and supposed funding pools, the company operated in total opacity. This raised serious concerns about how challenge fees were being used—and whether there was any real trading capital backing their operations at all.

Whispers from former contractors and alleged insiders added fuel to the fire. Some claimed the firm manipulated trading dashboards and disqualified profitable accounts through algorithmic flags designed to reduce payout liabilities. Others suggested the core operation resembled a Ponzi scheme, where new challenge fees funded prior payouts—until the math no longer worked.

As of June 2025, no official criminal charges have been filed, but regulatory bodies in the U.S. and EU have reportedly opened investigations. Meanwhile, traders are left with little more than screenshots and empty accounts.

The Aftermath for Traders

The fallout was brutal. Hundreds—if not thousands—of traders were left high and dry. Many had passed SurgeTrader’s challenge and were actively managing funded accounts with profits they believed were real. Payouts ranging from a few hundred to tens of thousands of dollars simply vanished overnight. For some, it wasn’t just money—it was time, effort, and trust lost in an instant.

Challenge fees, which ranged from $250 to over $1,000 depending on the account size, became sunk costs. Traders scrambled to file chargebacks with credit card companies, PayPal, and other payment processors. Some succeeded, especially those who acted quickly. But many were denied refunds due to vague terms of service or delays in reporting the issue.

Beyond the money, the emotional toll hit hard. Confidence in the prop firm model took a major blow. Traders flooded Reddit threads, Telegram channels, and Discord groups to vent, share advice, and warn others. A recurring theme emerged: regret—for not acting sooner, for ignoring red flags, and for believing the hype.

This wasn’t just another scam. For many traders, it was their first step into professional markets. The damage wasn’t just financial—it shattered faith in a system that was supposed to empower independent traders, not exploit them.

What Authorities and Watchdogs Are Doing

So far, regulatory response has lagged behind the damage. SurgeTrader was not registered with the SEC, CFTC, or any other major financial authority, which allowed it to operate in a legal grey area. Because prop firms typically don’t manage client investments in the traditional sense—and traders technically operate under their capital—firms like SurgeTrader have been able to sidestep strict financial regulations.

Both the FTC and SEC have reportedly received complaints, but as of mid-2025, no formal enforcement actions or public investigations have been announced. This has left affected traders in limbo, with no clear path toward accountability or recovery.

A handful of law firms have started exploring class action lawsuits, collecting testimonies and documentation from former SurgeTrader users. However, these efforts face significant legal hurdles. Without clear jurisdiction or regulatory classification, it’s difficult to pursue damages, especially if the company was structured offshore or has already liquidated assets.

The collapse has reignited conversations around the need for greater oversight in the prop trading space. Right now, the industry is largely self-regulated—leaving independent traders vulnerable to predatory or mismanaged firms. Until proper guardrails are in place, traders remain exposed to serious risks with little legal recourse when things go wrong.

Similarities Between Valo Holdings Group and SurgeTrader: A Pattern of Risk in Plain Sight

After the collapse of SurgeTrader, many traders were stunned to discover that its founder had quietly launched a new venture: Valo Holdings Group. Marketed as a venture capital and innovation platform, Valo claims to “build and scale companies that disrupt,” but a closer look reveals disturbing parallels between it and the now-defunct prop firm.

Both SurgeTrader and Valo Holdings operate in regulatory gray zones. SurgeTrader, despite handling millions in trader fees and offering access to “funded” trading capital, was never registered with the SEC, CFTC, or any reputable financial oversight body. It labeled itself as an education and funding platform, effectively skirting investment regulations while collecting payments from thousands of users.

Valo Holdings follows a similar pattern. It’s positioned more as a brand incubator or private equity-style entity, yet it lacks the disclosures, transparency, or oversight you’d expect from a legitimate investment organization. There’s no evidence of it being registered with the SEC, nor are there any audited financial statements or clear information about how investor capital (if any) is handled.

The websites of both companies share the same polished veneer: bold promises, minimal substance. SurgeTrader promised traders a fast track to capital; Valo promises to revolutionize industries. In both cases, the branding is slick—but the legal structure is vague, and the accountability is nonexistent.

For traders and investors alike, this raises a critical question: is this just a rebranding of the same high-risk, low-transparency model under a new name? The similarities aren’t just cosmetic—they point to a pattern that deserves serious scrutiny.

Final Thoughts on Valo Holdings Group

SurgeTrader’s collapse left a scar on the prop trading landscape. It exposed how fragile these setups can be—and how vulnerable traders are when protections don’t exist.

But it also sparked a conversation: what should the future of prop trading look like? Regulation may be coming. Accountability must improve. And until then, traders must protect themselves by choosing firms with real transparency, not just shiny marketing.

If you were affected by SurgeTrader, share your story. Awareness is the first step toward protecting the next trader from getting burned.