Quantvision Business Institute appears to be a shady AI trading scam which focuses on cryptocurrencies. Based on multiple user reports and the evidence available, it is likely a scam. There are many such scams operating in the current market.

You should exercise caution when dealing with Quantvision Business Institute. It would be best if you ignored them altogether.

As artificial intelligence (AI) continues to revolutionize various sectors, its integration into cryptocurrency trading has generated significant interest and enthusiasm. From algorithmic trading bots to predictive market analysis, AI has promised increased efficiency, speed, and accuracy. However, this technological advancement has also become fertile ground for exploitation. In recent years, AI trading crypto scams have emerged as a sophisticated and alarming trend, targeting both novice and experienced investors alike.

What Are AI Trading Crypto Scams?

AI trading crypto scams are fraudulent schemes that claim to use advanced AI algorithms to trade cryptocurrencies and deliver high, consistent profits. These platforms often market themselves as cutting-edge fintech solutions capable of outperforming the market using machine learning, real-time data analysis, and predictive modeling. However, in most cases, these so-called “AI bots” either don’t exist or fail to function as advertised. Instead, the platforms are designed primarily to extract funds from users before disappearing or collapsing.

The Typical Structure of the Scam

These scams often follow a common pattern:

1. The Hype

The scam begins with aggressive online marketing. Victims are targeted through social media ads, YouTube videos, sponsored blog posts, Telegram groups, and even fake news sites. Promises of “guaranteed returns,” “zero risk,” and “passive income through AI” dominate the promotional material. Influencers or fake testimonials are used to build trust and credibility.

2. Initial Onboarding

Users are asked to register and make an initial deposit, usually in cryptocurrency like Bitcoin (BTC), Ethereum (ETH), or Tether (USDT). The dashboard mimics a professional trading interface, and fake performance data often displays rising profits to keep users engaged.

3. Encouraging Bigger Investments

Once a user sees initial (fabricated) returns, the platform encourages further deposits. Some may introduce VIP tiers or bonus incentives to lure users into investing more. Referral schemes are also common, where users are rewarded for bringing in others.

4. The Disappearance or Lock-In

Eventually, the platform either vanishes, disables withdrawals, or blocks users entirely. Common excuses include “security checks,” “platform upgrades,” or “regulatory issues.” By the time users realize they’ve been scammed, the perpetrators have often moved the funds and shut down the operation.

Real-World Examples

Several high-profile scams have followed this pattern:

- BitAI: Marketed as an AI-powered crypto trading bot, BitAI lured thousands of users before abruptly shutting down and locking out users from their accounts.

- Immediate Edge: Heavily promoted via social media, this platform claimed to use AI to predict Bitcoin price movements. Investigations revealed fake testimonials and nonexistent trading systems.

- DeepTradeBot: Claimed to use deep learning for trading but was flagged by multiple watchdogs for operating as a Ponzi scheme. It eventually collapsed, leaving users with nothing.

These platforms shared common traits: anonymous teams, vague technology claims, unregulated operations, and aggressive recruitment tactics.

Why AI Is an Easy Hook for Scammers

The appeal of AI lies in its complexity and mystique. Most people do not fully understand how AI works, making it easy for scammers to use technical jargon and buzzwords to create the illusion of legitimacy. Terms like “neural networks,” “machine learning algorithms,” and “predictive analytics” are thrown around to confuse or impress potential victims. This could be a reason why Quantvision Business Institute throws around the word “AI trading” so much.

Moreover, the inherent volatility and unpredictability of crypto markets make high returns plausible to the untrained eye. The combination of tech hype and financial desperation makes for a dangerous mix, especially for new investors looking to “get rich quick.”

Red Flags to Watch Out For

Here are some warning signs that a platform may be a scam:

- Guaranteed or fixed returns – No legitimate trading system can promise consistent profits.

- Lack of transparency – If there’s no information about the team, technology, or trading strategy, be cautious.

- Unregulated platforms – Always check if the platform is registered with a recognized financial authority.

- Pressure to refer others – MLM-style referral programs are often used in scams.

- Anonymous or unverifiable claims – Be skeptical of celebrity endorsements or success stories with no proof.

You must have noticed that Quantvision Business Institute has almost all of these red flags.

How to Protect Yourself from Companies like Quantvision Business Institute

- Do your research: Look for independent reviews and warnings from crypto watchdogs or financial regulators.

- Use reputable platforms: Stick to well-known exchanges and tools with established track records.

- Never invest based on hype: Be cautious of unsolicited messages, ads, or offers.

- Test before trusting: If a platform offers a trial, don’t deposit large amounts upfront.

Thus, AI technology has real potential in transforming the world of finance, but bad actors are using its popularity to create elaborate scams. Investors must remain vigilant and skeptical of platforms that promise fast, effortless profits through AI-powered trading. In the crypto world, where regulation is still catching up, the best defense is informed caution.

Warnings Against AI Trading Crypto Scams: What Investors Must Know

As the cryptocurrency industry continues to grow, so too does the sophistication of scams targeting hopeful investors. Among the most concerning trends in recent years is the rise of AI trading crypto scams, fraudulent schemes that falsely claim to use artificial intelligence for high-yield automated trading. While these platforms lure users with promises of effortless wealth, global regulators and cybersecurity experts have raised alarms about their deceptive nature.

This article explores the different warnings issued against AI trading crypto scams, highlighting red flags, regulatory alerts, and expert advice to help investors stay safe in an increasingly complex digital marketplace.

1. Regulatory Warnings from Financial Authorities

U.S. Securities and Exchange Commission (SEC)

The SEC has repeatedly warned investors about platforms offering “guaranteed returns” through automated or AI-based trading bots. In multiple investor alerts, the SEC emphasizes that no investment is risk-free, and that AI claims should be viewed with skepticism especially when the company is unregistered.

In 2023, the SEC’s Office of Investor Education and Advocacy issued a statement urging the public to “beware of fraudulent investment schemes involving AI.” The agency highlighted cases where scammers used AI buzzwords to give false credibility to Ponzi schemes and fake trading platforms.

U.K. Financial Conduct Authority (FCA)

The FCA has also cautioned consumers about unregulated AI crypto platforms. Many fraudulent websites clone or spoof legitimate financial services firms, pretending to be licensed by the FCA. The FCA regularly updates its Warning List, which includes a growing number of fake AI crypto trading services.

They warn, “If you invest through a firm that is not authorised by us, you won’t have access to the Financial Ombudsman Service or Financial Services Compensation Scheme (FSCS) if things go wrong.”

European Securities and Markets Authority (ESMA)

In the European Union, ESMA has echoed these concerns, especially in light of the growing number of crypto scams targeting retail investors. ESMA specifically urges caution around unsupervised algorithmic trading platforms, noting that many are intentionally misleading users with fake AI claims.

2. Cybersecurity and Consumer Protection Organizations

Federal Trade Commission (FTC) – United States

The FTC has documented a spike in crypto-related fraud involving AI, including deepfake videos and fabricated testimonials. In particular, the FTC highlighted that fraudsters are using AI to create fake Elon Musk or celebrity endorsements promoting scam crypto bots.

Their consumer alert reads: “If someone tells you that AI can make you rich through crypto trading, that’s your cue to walk away.”

Better Business Bureau (BBB)

The BBB has received hundreds of complaints involving fake crypto bots that claim to use AI for trading. Many consumers reported that they were shown demo accounts with simulated profits, only to find they couldn’t withdraw their money. The BBB recommends verifying company identities, checking for complaints, and being cautious of platforms that accept only cryptocurrency deposits.

3. Warnings from Crypto Industry Experts

Many crypto analysts and blockchain security firms have issued independent warnings about AI trading scams. Key insights include:

- SlowMist and CertiK: Blockchain security companies like SlowMist and CertiK regularly publish threat intelligence reports. These show that many “AI trading bots” are really just smart contract honeypots or front-end scams, where users lose access to their funds instantly upon deposit.

- Crypto influencers and educators: Prominent voices on YouTube and Twitter (X) have warned their audiences about popular scam platforms like Immediate Edge, Bitcoin Era, and BitAI all of which falsely claim to use AI for crypto arbitrage or auto trading.

4. Red Flags Highlighted in Public Warnings

Across all these advisories, some common red flags have emerged:

- Guaranteed profits: No legitimate trading system, AI or otherwise, can promise consistent returns.

- Lack of transparency: Scam platforms usually avoid disclosing who developed the AI, what the algorithm does, or how it’s tested.

- Unregulated operations: If a platform is not registered with any financial authority, it’s often a scam.

- Fake testimonials and reviews: Many scams use AI-generated or paid actors to deliver glowing testimonials.

- Withdrawal restrictions: Victims report being unable to access funds once they request a payout.

5. What You Can Do to Protect Yourself

- Verify registration: Always check if a platform is licensed by a recognized financial authority.

- Research thoroughly: Look for independent reviews, regulatory warnings, and complaints.

- Be skeptical of marketing claims: Just because a platform says it uses “AI” doesn’t mean it does or that it works.

- Use reputable platforms: Stick to well-known exchanges or services with strong regulatory oversight.

The promise of AI-powered trading may sound enticing, but the reality is far more dangerous when combined with crypto’s lack of regulation. Financial regulators, cybersecurity agencies, and industry experts have issued strong and repeated warnings: AI trading crypto scams are on the rise, and they are increasingly sophisticated.

In this environment, staying informed is not just helpful it’s essential. If a platform promises easy profits through AI and crypto, chances are it’s too good to be true.

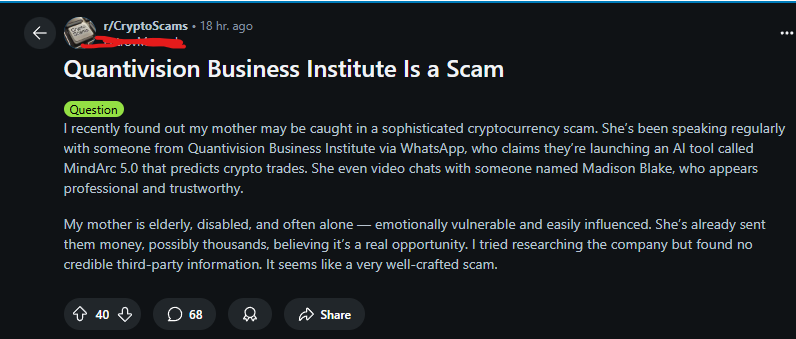

Reddit Post: Quantivision Business Institute: A Sophisticated Cryptocurrency Scam Targeting the Vulnerable

As cryptocurrency scams become increasingly elaborate, families are facing the harsh reality that even intelligent, well-meaning loved ones can fall prey to deception. One such case involves a company calling itself Quantivision Business Institute, which appears to be behind a carefully crafted fraud targeting an elderly and vulnerable woman under the guise of artificial intelligence and crypto trading.

The Setup: Promises of AI-Powered Crypto Profits

The victim, a disabled and aging mother, has been in regular communication with a representative from Quantivision Business Institute via WhatsApp—a red flag in itself. The representative promotes an AI tool named MindArc 5.0, which they claim will launch soon and can predict cryptocurrency trading opportunities with precision.

Adding a disturbing layer of legitimacy, the mother has even engaged in video calls with an individual identifying herself as Madison Blake, who presents herself as a professional and trustworthy figure associated with the company. This tactic, whether real or staged, has deepened the victim’s belief that the operation is legitimate.

Unfortunately, she has already sent money to the group, possibly in the thousands convinced that she is investing in a rare and profitable opportunity.

A Disturbing Pattern of Deception

Attempts to research Quantivision Business Institute reveal an alarming lack of credible information. The company appears to exist only through its own website and self-published promotional content. No third-party news outlets, business registries, or financial regulatory databases list any legitimate record of the organization, its team, or its technology.

This is a common tactic in high-level scams. Fraudsters often create polished websites, publish fake press releases, and use professional-looking profiles or videos to mimic the legitimacy of a real company. By impersonating financial innovation—especially involving AI and crypto—these scams exploit both the hype of emerging technology and the emotional vulnerabilities of their targets.

Why This Case Is Particularly Concerning

This situation reflects a dangerous evolution in scam tactics:

- Direct messaging platforms like WhatsApp are being used to bypass traditional safeguards.

- Emotional manipulation through video calls fosters a false sense of connection and trust.

- AI as a buzzword is being leveraged to sell the illusion of cutting-edge opportunity.

- The target is isolated, elderly, and emotionally vulnerable—fitting the profile of individuals most at risk for financial exploitation.

What makes this case especially alarming is how convincing and persistent the scam appears. The integration of face-to-face video interaction adds psychological weight and makes it harder for victims to accept that they’re being deceived—even when confronted with evidence.

The Bigger Picture: A Growing Threat

The case of Quantivision Business Institute is just one example of a rising trend in AI-powered crypto scams, or at least scams that claim to be AI-driven. These schemes prey on fear of missing out (FOMO) and the illusion of technological superiority. By claiming to offer predictive tools for trading and targeting emotionally vulnerable people, they blur the line between innovation and manipulation.

It’s also a powerful reminder that scammers do their homework. They know how to present themselves professionally, they understand how to build trust over time, and they exploit weaknesses not just in individuals, but in entire systems—financial, technological, and emotional.

What Can Be Done?

If you suspect someone you love is involved in a scam like this, here are critical steps to take:

- Start with empathy: Don’t accuse or shame. Victims often double down on their belief if they feel attacked.

- Gather evidence: Save communications, website links, and any payment records.

- Report the scam:

- In the U.S.: File with the Federal Trade Commission (FTC) and the Securities and Exchange Commission (SEC).

- Internationally: Contact local consumer protection agencies or cybercrime units.

- In the U.S.: File with the Federal Trade Commission (FTC) and the Securities and Exchange Commission (SEC).

- Involve financial institutions: Help the victim contact their bank or crypto platform to block or reverse transactions if possible.

- Educate and support: Share stories of similar scams to break the illusion. Sometimes hearing about others in the same situation helps victims see the truth.

Final Thoughts

The story of Quantivision Business Institute is a chilling example of how advanced and manipulative cryptocurrency scams have become. They no longer rely on poor grammar and crude tactics; instead, they use tailored communication, fabricated personas, and cutting-edge narratives to ensnare victims.

As the digital finance landscape evolves, so too must our vigilance. Education, empathy, and swift action are our best defenses against this growing wave of deception.

Rising Tide of Crypto Scams in the U.S.

- In 2024, consumers lost approximately $9.3 billion to cryptocurrency-related fraud in the U.S.—a dramatic 66% increase over 2023.

- Globally, at least $9.9 billion was stolen via on‑chain crypto scams in 2024, largely through “pig butchering” and other investment schemes.

- The FBI’s Internet Crime Complaint Center received around 69,000 reports of crypto fraud in 2023, with total losses of $5.6 billion (a 45% surge from 2022).

Scams Targeting Vulnerable Groups & Platforms

- Seniors were hit hardest: Americans over 60 reported losses totaling $2.8 billion in crypto scams in 2024.

- Fraud via Bitcoin ATMs alone cost seniors around $107 million in 2024. In the first half of the year, ATM-related scams totaled $65 million, with median losses near $10,000 per incident.

- Pig butchering, a romance-turned-investment scam, grew roughly 40% in 2024 and made up over 33% of total crypto scam revenue—about $12.4 billion globally.

FTC & FBI: Big Numbers in Broader Fraud

- The FTC reported U.S. consumers lost $12.5 billion to all scam types in 2024—investment fraud contributed $5.7 billion, with crypto and bank transfer scams topping other forms of payment.

- The FBI’s 2024 IC3 report flagged crypto-related fraud losses at $9.3 billion, with over 5,400 victims notified and nearly half of total cybercrime losses going to sextortion and investment schemes.

High-Profile Cases & Law Enforcement Response

- In February 2025, North Korea–linked hackers stole $1.5 billion from ByBit exchange, reportedly the largest crypto heist ever.

- A 19-year-old in Connecticut pleaded guilty to a $245 million Bitcoin theft, part of a broader $260 million fraud ring, and was linked to the kidnapping of his parents.

- In June 2025, the DOJ filed to seize $225 million in crypto tied to “pig butchering” schemes that victimized over 400 people.

- Several states (Illinois, Vermont, Rhode Island, Nebraska, Arizona) and cities like Spokane have passed or are enforcing laws limiting or banning Bitcoin ATMs due to fraud.

Scam Evolving Tactics & Preventive Efforts

- Scammers increasingly rely on AI voice tools, social engineering, and technical support bot frauds, sometimes targeting users on platforms like Twitter and YouTube.

- The FBI’s Operation Level Up (early 2024) helped identify 4,300 crypto scam victims and prevented nearly $286 million in prospective losses.

- Operation First Light—a joint effort across 61 countries—resulted in 3,950 arrests and seizure of $257 million tied to online fraud, though not limited to crypto.

What Lies Ahead

- State-level regulation of Bitcoin ATMs is expanding, aiming to reduce elder-targeted fraud.

- Enhanced coördination between DOJ, FBI, SEC, and state agencies shows growing priority on crypto scam enforcement.

- Tech-forward defenses—AI-based scam detection, blockchain tracing, public awareness campaigns—are essential to outpace scammers.

Final Thoughts

Crypto trading scams in the U.S. are surging—reaching into the tens of billions annually—and hitting all age groups, especially older adults. The rapid growth of scam revenue and the sophistication of tactics demand stronger regulation, smarter tech tools, and vigilant users. If you’d like, I can provide tips on how investors can protect themselves or a breakdown of upcoming state regulations.